Diamond Standard Coins

Whereas gold, silver and other precious metal bullion coins are traded as commodities worldwide and have a constantly fluctuating spot price, the same is not the case for diamonds. Their value cannot be standardized in the same way, at least not until now, since diamonds don’t only vary in size (carat) but also in color, clarity, cut and the number of physical imperfections. A startup company is now trying to change all that through the issue of Diamond Standard Coins, which – if successful – would turn diamonds into standardized commodities with the potential for worldwide electronic trading.

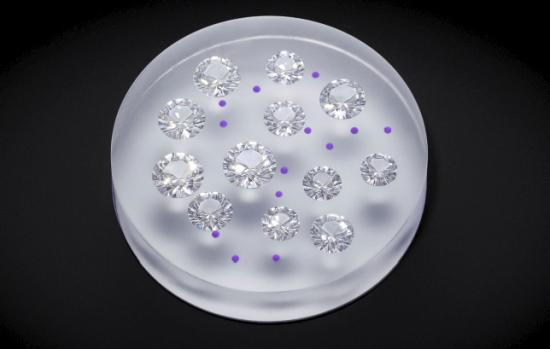

You might be rightfully wondering now how an individual diamond (or a certain number of diamonds) can be turned into a coin? The answer to this question is simpler than most people would assume. Each Diamond Standard Coin contains a statistically calibrated set of diamonds which are encased in a transparent resin. Therefore, each coin stores exactly the same value in the form of diamonds. Also encased within the resin along with the diamonds is a military-grade wireless encryption chip. This chip stores a digital token that uses blockchain technology. This innovative method enables the authentication and electronic trading of the coin on digital exchange platforms.

Can Diamond Standard Coins become a potential rival for precious metals in the commodity market?

However, there is one important condition to the electronic trading of Diamond Standard Coins. You will only be able to trade such coins electronically as long as they are held in custody by a custodian that is approved by CME Globex and other trading platforms.

The startup company Diamond Standard Inc. is headquartered in New York City and it has already obtained permission from the Bermuda Monetary Authority to issue 5000 Diamond Standard Coins for an initial price of 5000 USD each. You can read all relevant information about the regulated offering here. The approximately 50,000 diamonds that will be needed to produce the first 5000 Diamond Standard Coins will be purchased through a transparent bidding process on the Diamond Standard Exchange (DSE).

It is planned that the coins will be delivered to the initial investors or their custodians about 28 days later. From that moment on, it will be possible to trade the coins on digital exchanges and that initial trading on all the different exchange platforms will establish a market price, similar to how the spot price of gold, silver and other precious metals is determined.

I’m sure Diamond Standard Coins will see a successful introduction to the commodity market. Nevertheless, I would advise against investing in this new type of commodity. The reason for that is simple, the worldwide supply of diamonds is essentially controlled by one company.

The South African company De Beers S.A. has controlled the diamond market for a long time. At one point, they held an 85% market share. Officially, their market share has slipped to only 29.5% in 2019. However, I suspect their real market share to be much higher through their investments in and affiliations with other companies. Therefore, if De Beers wants the market price of Diamond Standard Coins to increase, all they have to do is to throttle their supply of diamonds to the world market.